Origin Staffing - Thoughts on Recruitment

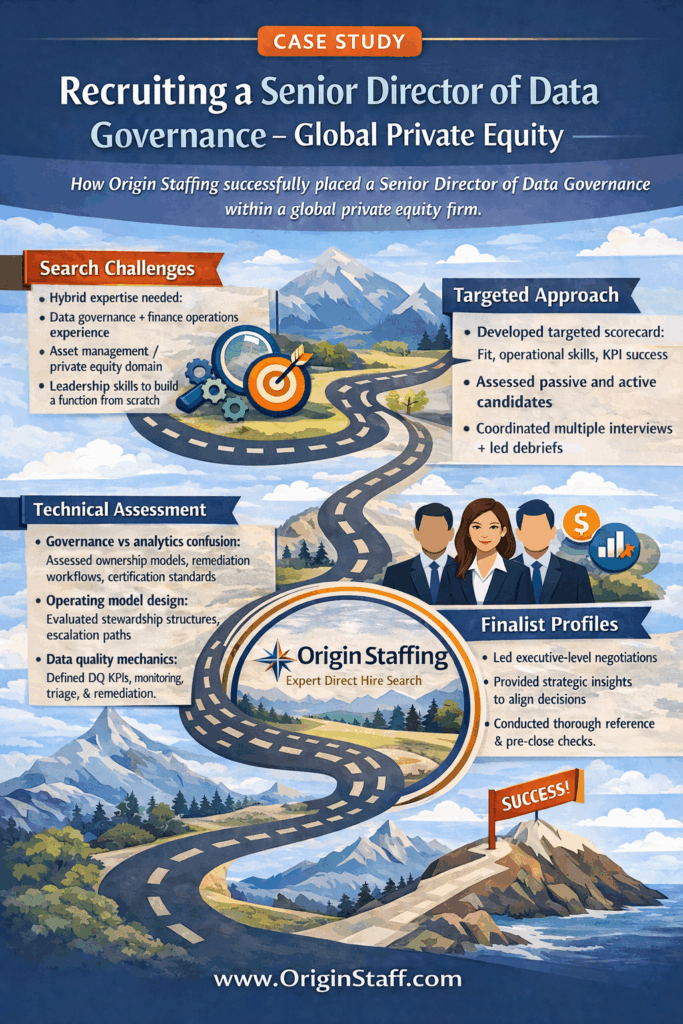

Recruiting a Senior Director of Data Governance – Global Private Equity – Search Agency Case Study

Hiring a Senior Director of Data Governance inside a global private equity firm is rarely a straightforward “data leadership” search. This case study covers what made the mandate complex, how Origin Staffing translated a broad job description into a decision-grade scorecard, effectively recruiting top talent, and how the client ultimately hired a leader who could stand up governance from scratch while reducing investor and management reporting errors.

Executive Summary

- Mandate: Stand up a centralized data governance framework for a capital markets platform, with success measured by fewer data errors in investor reporting and internal management reporting.

- Operating reality: Governance needed to work across multiple asset classes and workflows (including high-volume, deadline-driven reporting environments).

- Why it was hard: The role required a hybrid profile – data governance leadership, deep investment operations fluency, and the ability to drive adoption across senior stakeholders without “owning” every upstream system.

- How Origin Staffing ran the search: We built a scorecard around proof-of-fit artifacts (DQ KPI design, lineage, remediation workflows, certification) rather than tool keywords alone, then mapped talent across adjacent but relevant ecosystems.

- What “good” looked like: A leader who had built governance capabilities from zero to adoption – including ownership models, domain definitions, data catalog and glossary discipline, and practical escalation / remediation mechanics.

- Outcome: The client selected a finalist who demonstrated executive presence, strong cross-functional influence, and repeatable program-building experience. The offer was accepted immediately, aligning with market expectations at the Senior Director level.

Role Context and Why This Senior Director Hire Mattered

In alternative asset management, data governance is not an abstract “data office” initiative. It is operational infrastructure that determines whether investor reporting, management dashboards, and downstream decisioning can be trusted during peak cycles.

For this client, the new function needed to:

- Reduce reporting risk by systematically preventing and remediating data errors (not just detecting them).

- Create enterprise-level clarity on data definitions, ownership, and certification – especially where teams rely on shared datasets but interpret them differently.

- Scale across product complexity where the same “metric” can mean different things depending on fund structure, asset class, or lifecycle stage.

- Drive adoption across business users, operations, reporting teams, and technology partners – without slowing the business down.

A key indicator of seriousness was stakeholder involvement. The interview process intentionally included senior leaders from investment operations, technology, fund finance, and risk – reflecting that governance would touch each of those areas and needed broad buy-in.

Why the Search Was Hard

Origin Staffing saw seven concrete complexity drivers that are common in Senior Director-level data governance searches in private markets and credit platforms:

- Scarcity of true hybrids: Many candidates were strong in governance frameworks but light on investment operations, or vice versa.

- Governance vs analytics confusion: A subset of the market leads BI or data products, but has not owned data ownership models, remediation workflows, or certification standards.

- Adoption is the real work: The mandate required influence and change management, not just policy writing.

- Tool familiarity is not enough: The client needed someone who could build the operating model (owners, KPIs, escalations, sign-offs) independent of vendor tooling.

- Cross-functional calibration risk: Investment ops, fund finance, IT, and risk often prioritize different definitions of “good data.” Aligning them required maturity and diplomacy.

- Program-building under deadlines: This function had to mature while the business continued running at a high transaction volume and tight reporting schedules.

- Leveling and comp dynamics: At Senior Director level, candidates compare total package design, long-term incentives, and role scope, not just title.

Origin Staffing Intake and Calibration – Turning the Job Description Into a Real Scorecard

We converted the job description into a scorecard with evaluation dimensions that would survive stakeholder debate. The goal was to avoid hiring someone who “sounds right” but cannot execute once the program hits real friction.

Scorecard – core dimensions (what Origin Staffing tested for):

- Operating model design: Ownership model, domain accountability, steward structure, escalation paths.

- Data quality mechanics: Definition of DQ KPIs, thresholds, monitoring, triage, and remediation workflow.

- Lineage and controls mindset: Ability to trace issues to root cause and implement durable mitigations (not permanent workarounds).

- Catalog, glossary, dictionary discipline: Practical approach to building and maintaining shared definitions and report inventories.

- Certification and sign-off: How to create “trusted” reports and datasets with accountable approvals.

- Investment operations fluency: Understanding how portfolios, funds, and reporting workflows actually run in a private markets / credit environment.

- Vendor and IT partnership: Ability to lead vendor relationships and prioritize builds with technology partners without requiring direct programming.

- Executive communication: Ability to socialize progress to senior leadership with metrics that stand up to scrutiny.

- Team building: Ability to hire, develop, and scale a small team (starting lean, expanding over time).

- Change management under pressure: Proven track record driving adoption in deadline-driven environments.

To ground the governance conversation in broadly recognized best practices, Origin Staffing referenced frameworks such as BCBS 239 and practical governance guidance like the NIST Privacy Framework.

Market Mapping – Where Origin Staffing Looked and Why

Rather than over-indexing on one “perfect” background, we mapped candidate ecosystems that consistently produce the needed hybrid skills:

- Buy-side data governance leaders within asset managers and investment platforms (strongest direct translation).

- Investment operations and reporting leaders who had built governance-like controls even without the “data governance” title.

- Regulated financial services governance leaders (especially those who owned lineage, data quality, and control frameworks) – strong rigor, but required investment ops validation.

- Risk and controls leaders adjacent to data aggregation and reporting obligations (high governance maturity, but needed operating model applicability).

- Technology-adjacent governance leaders who had partnered deeply with IT and vendors while staying anchored in business outcomes.

Backgrounds screened out (and why):

- Pure IT governance / architecture profiles with limited ownership of business data domains and adoption.

- Analytics-only leadership (dashboards and insights) without remediation workflows and certification rigor.

- Overly niche product backgrounds where governance was constrained to a single dataset or narrow business line.

Screening for Proof-of-Fit – Our Approach

At Senior Director level, resumes are rarely the differentiator. Proof is.

Origin Staffing tested depth using “show me” prompts that do not rely on proprietary details, such as:

- Walkthrough of a DQ KPI framework they built – how metrics were chosen, what thresholds meant, and how remediation was enforced.

- Example of a root cause deep dive – what the initial symptom was, how lineage was traced, and what was changed to prevent recurrence.

- How they built and maintained a business glossary and catalog without it becoming shelfware.

- How they implemented report certification and handled exceptions during peak reporting periods.

- How they approached vendor tooling decisions using a build/buy/partner mindset, referencing models like the EDM Council DCAM.

- How they handled data and model governance adjacency, using references like the NIST AI Risk Management Framework where appropriate.

We also pressure-tested stakeholder management using scenarios where governance conflicts with speed – and whether the candidate could protect reporting integrity without becoming a blocker. Controls-minded references like the AICPA SOC reporting framework helped anchor discussions about assurance and evidence.

Finalist Profiles – What Origin Staffing Put In Front of the Client

Origin Staffing presented three finalist archetypes and stakeholders debated tradeoffs cleanly.

Candidate Profile A – Enterprise Data Governance Builder (Regulated Financial Services)

Strengths

- Deep rigor around ownership models, lineage, cataloging, and DQ workflows.

- Strong comfort operating with auditability and control expectations.

- Repeatable approach to standing up governance capabilities.

Risk factors

- Needed validation on investment operations nuance (fund structures, reporting cycles, stakeholder expectations).

Candidate Profile B – Investment Operations Leader with Governance-by-Execution

Strengths

- Very strong understanding of how reporting breaks – and how to fix it.

- Natural credibility with operations and reporting teams.

- Practical mindset that tends to drive adoption.

Risk factors

- Less formal governance architecture experience – risk of under-building catalog, certification, and long-term operating model.

Candidate Profile C – Data Governance + Product Mindset (Platform and Vendor Heavy)

Strengths

- Strong at scaling tooling, vendor relationships, and user experience.

- Good at roadmap building and stakeholder communications.

- Can accelerate catalog and workflow rollout.

Risk factors

- Needed proof they could lead accountability models and enforcement, not just enablement.

The eventual hire aligned closest to the “builder” profile – with unusually strong adoption instincts and executive communication.

Interview Feedback Loop – How the Search Tightened

The interview sequence itself clarified the real success criteria:

- Early rounds validated vision and leadership presence – could the candidate represent governance credibly to senior stakeholders.

- Mid rounds surfaced domain nuance – whether the candidate truly understood investment reporting friction points and could speak the language of fund finance and operations.

- Later rounds tested cross-functional buy-in – including leaders from technology, risk, and operational functions.

Two things materially improved decision quality:

- The stakeholder map was deliberate. The interviewers represented the exact functions that would later become data owners, consumers, or escalation partners.

- Calibration became sharper over time. Feedback moved from “does this sound right?” to “can this person build a governance operating model that survives real reporting pressure?”

Offer Design and Closing a Senior Director of Data Governance in Global Private Equity

At this level, closing is less about selling the brand and more about managing risk on both sides.

What mattered in this close:

- Leveling clarity: Senior Director-level scope had to match title – including the authority to define ownership and enforce adoption.

- Total compensation design: Competitive base pay, meaningful annual incentive opportunity, and a substantial employer retirement / profit-sharing contribution that is typical of top-tier alternatives platforms.

- Longer-term upside mechanics: In addition to annual incentives, the offer included a firmwide performance element – often more meaningful than a one-time sign-on.

- Earned compensation considerations: We confirmed what the candidate was realistically walking away from in the current year to avoid surprises late in the process.

- Non-cash drivers: Executive sponsorship, clear mandate, ability to build a team, and ownership of a high-priority initiative were central to acceptance.

In this case, the candidate’s conviction increased each round because the interviews reinforced two themes – senior buy-in was real, and the mandate was not symbolic. When that combination is credible, acceptance velocity improves dramatically.

What Hiring Managers Can Learn From Origin Staffing’s Process

- Hire for operating model design, not tools. Tools enable; they do not govern.

- Validate investment operations fluency early. This reduces late-stage “domain mismatch” risk.

- Build stakeholder alignment into the interview plan. The functions that own inputs and outputs must buy in.

- Confirm earned comp and long-term incentives before the final round. This keeps closing clean.

- Momentum reduces drop-off and counteroffer risk. Tight scheduling matters at Senior Director level.

FAQ

What makes hiring a Senior Director of Data Governance difficult in private equity?

The role sits at the intersection of governance rigor and investment operations reality. Many candidates are strong in one side but have not proven they can drive adoption across senior stakeholders while protecting reporting integrity under deadlines.

What backgrounds translate best into this role?

The strongest profiles typically come from buy-side governance roles, investment operations leaders who have built governance-like controls, or regulated financial services governance leaders with proven program-building experience. The common thread is repeatable operating model design and credible stakeholder influence.

How do you evaluate depth vs keyword familiarity in data governance?

Origin Staffing looks for specific examples – DQ KPI design, remediation workflows, certification standards, lineage-driven root cause analysis, and ownership models. Candidates who can articulate these with clarity and outcomes tend to perform well once in seat.

What compensation structures are common at this level?

Total packages often combine base pay, an annual incentive bonus, and meaningful employer retirement or profit-sharing contributions. Some platforms also include a firmwide performance-based components.

If it’s helpful to talk through a current hiring need, you can reach us via Contact Us, and follow updates on the Origin Staffing LinkedIn company page.

This search was led by Andrei Nikulin – Head of Recruiting at Origin Staffing